October 30, 2021

EUR/USD: After ECB Meeting, Ahead of Fed Meeting

- Last time the EUR/USD review was titled “In a state of uncertainty”, as confirmed by the previous week. Starting at 1.1643, the pair dipped to 1.1581, then rose to 1.1691, and ended the session with a new drop, this time to the 1.1560 level.

The main event last week was the European Central Bank meeting. As expected, the interest rate remained unchanged at 0%. Therefore, the commentary of the ECB management on monetary policy was of much greater interest. After the US Federal Reserve and the Bank of England outlined the timing of the start of curtailing their monetary stimulus (QE) programs, investors wanted to hear similar statements from the ECB. But… they didn’t hear them: the regulator’s press release practically repeated the previous one of September.

According to Bloomberg insider information, there is currently a split among ECB Governing Council members. First and foremost, this concerns estimating the extent of the upcoming inflation. ECB President Christine Lagarde's assurances that the recent rise in inflation to 3.4% is temporary does not suit all. Even more so, they look doubtful against Germany's 28-year inflation peak (4.6%) and Spain's 37-year peak (5.5%). The statement of the bank's management that the analysis does not confirm the need to raise the interest rate in 2022 also looks dubious.

All of the above has led investors to feel that the withdrawal of monetary stimulus in the Eurozone will not begin until late 2022 and early 2023. Against this backdrop, the European currency should have to weaken sharply. But if we look at the chart, we will see a sharp increase of the EUR/USD pair: the EUR/USD pair rose 110 points on October 28. Surprising but true!

The main reason lies in the macro statistics from the US, which came out at the same time as the ECB chief's press conference began. According to preliminary estimates, US GDP in Q3 will be 2.0%, well below not only the previous 6.7% but also the 2.7% forecast. The growth rate of the US economy fell from 12.2% to 4.9%. The figures tempered investor optimism and caused the dollar to weaken, with the USD index (DXY) falling from 93.86 to 93.33, and the Dow Jones and S&P500 stock indices almost returning to their historic highs. Falling gas and coal prices also played against the dollar, reducing the likelihood of an energy collapse in Europe.

At the end of the week, on Friday October 29, the dollar was able not only to win back losses, but also pushed the EUR/USD pair down to three-week lows. Investor positioning was key to this after the release of the US Fed's report on economic conditions, known as the Beige Book, ahead of the regulator's meeting next week. “With the Fed set to move to reduce asset purchases and flexibility, which is likely to be a key feature of future policy, the risk/return ratio becomes more positive for the dollar,” TD Securities analysts explained.

The dollar was also supported by a monthly gain on risk assets, a rise in bond yields to 1.672% (the highest since May) and good macro statistics from the US: the rise in the underlying PCE (Personal Consumption Expenditure) remained at 3.6% in September, in line with August. However, the European statistics caused another anxiety attack at investors, showing an acceleration in inflation and a sharp slowdown in GDP growth.

Despite the fluctuations of EUR/USD over the past few weeks, 100% of the trend indicators on D1 are looking south. But among oscillators, these fluctuations caused a certain amount of confusion: only 40% of them point south, 30% look north and 30% east. There is no unity among experts either. 30% vote for the growth of the pair, 55% for its fall, and 15% for lateral movement. Support levels are 1.1520, 1.1485, 1.1425 and 1.1250. Resistance levels are 1.1580, 1.1625, 1.1670, 1.1715, 1.1800, 1.1910.

As for important events and the release of macroeconomic statistics, there will be a lot of both in the coming week. German retail sales volumes and the ISM business activity index in the US manufacturing sector will be released on Monday November 01. The value of ISM in the service sector, as well as the ADP report on the level of employment in the US, will become public on Wednesday November 03. We will have such a key event as the Fed meeting on the same day, including the interest rate decision, as well as comments from its management on the US Central bank monetary policy. Christine Lagarde, head of the European Central Bank, is scheduled to speak on Wednesday and Thursday.

As usual, the first Friday of the month, November 05, will see data from the US labour market, including such an important indicator as the NFP, the number of jobs created outside the US agriculture sector. Eurozone retail sales statistics will be released the same day.

GBP/USD: Ahead of Fed and Bank of England Meetings

- The Consumer Price Index (CPI), which reflects the retail price performance of goods and services that make up the consumer basket of United Kingdom residents, and is a key inflation indicator, was +0.3% in September (vs. +0.4% and +0.7% in August). On a year-on-year basis, the UK CPI grew by +3.1% (vs. +3.2% forecast and +3.2% in August). Although indicators showed inflation slowing in September, analysts expect it to accelerate sharply in October due to high energy prices, utility tariffs and a partial increase in VAT.

The coming week is not only the week of the Fed meeting, but also of the Bank of England, which will take place on Thursday November 04. According to a number of experts, the slowdown in inflation in September is unlikely to force the UK regulator to stop raising its key interest rate in the coming months (now at 0.1%).

The threat of stagflation, combining weak GDP growth and high inflation, is highly dangerous for the British economy, which is still being pressured by the effects of Brexit. According to the Bank of England experts, the annual inflation rate will accelerate to around 5% by April 2022 and fall to the 2% target as late as by the end of 2022. This is a very fast pace, and the head of the central bank, Andrew Bailey, has recently said that at such rates, it may be necessary to act and raise interest rates faster than originally planned.

Many investors now believe that the interest rate on the pound could reach 0.45% by the end of 2021 and 0.95% by June 2022, which is supposed to lead to a stronger pound. However, in the current substandard situation, things are not so simple, and the curtailment of monetary stimulus could lead to a deterioration in the British economy, deepening crisis and a drop in living standards of the UK residents. Retail sales volumes (excluding fuel), as determined by the Office for National Statistics, have shown a year-on-year decline of -0.9% to -2.5% for three consecutive months, suggesting that people have started saving.

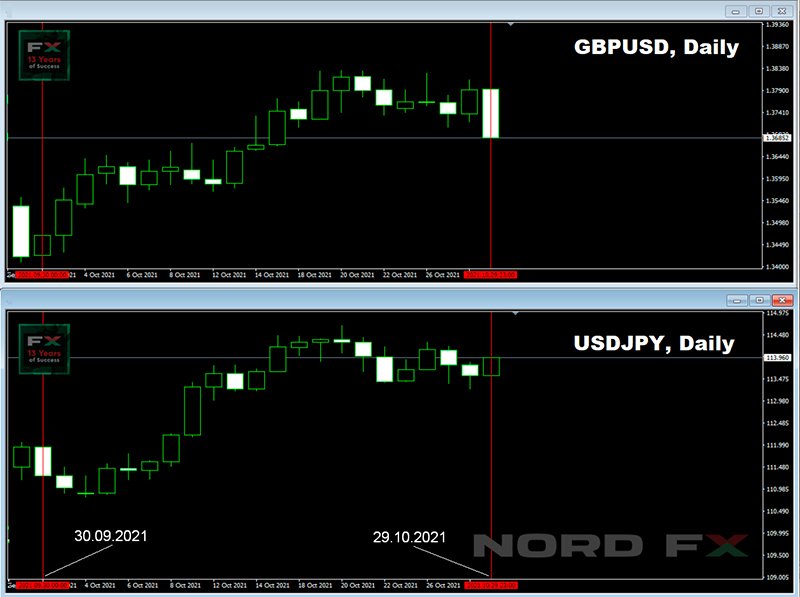

The last week and a half shows that the bullish momentum on the GBP/USD pair that started on September 30 has dried up and, thanks to the same factors listed for EUR/USD, the pound ended the trading session at 1.3685 a month later.

Intrigue as to how the market will react to plans by the US Fed and Bank of England to wind down QE remains for now. But it's safe to say that coming Wednesday and Thursday, when these regulators meet, promise to be very interesting, high volatility is guaranteed. At the same time, 40% of experts are betting on the bears winning, 30% along with the graphical analysis on D1 support the bulls, and the remaining 30% have taken a neutral position.

As many as 50% of the oscillators are neutral grey. The readings of the rest oscillators are divided equally: 25% for the red and 25% for the green. As for trend indicators on D1, reds win with a clear advantage, they are 80%. Support levels are 1.3765, 1.3675, 1.3600, 1.3575, 1.3525 and 1.3400. The resistance levels and targets of the bulls are 1.3725, 3770, 1.3810, 1.3835, 1.3900 and 1.4000.

USD/JPY: The Yen Has Its Own Path

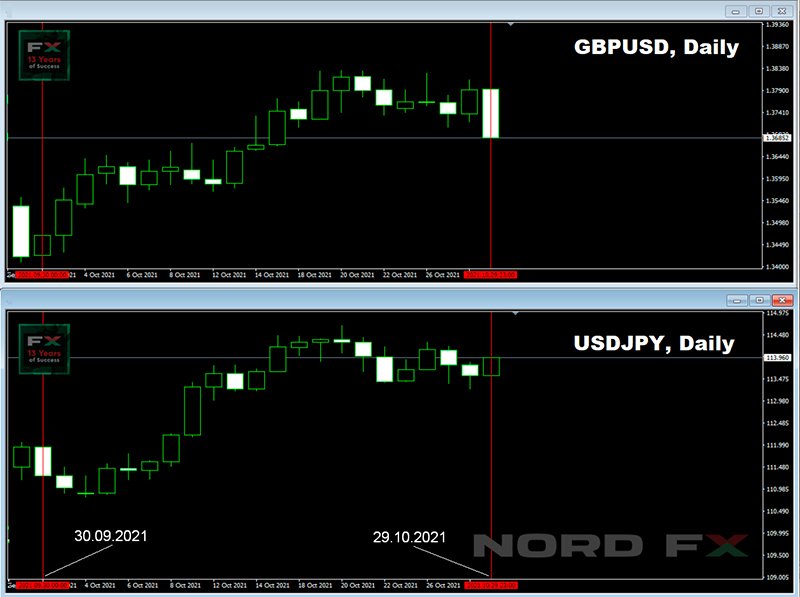

- Charts from the past two and a half weeks show that the upward momentum has dried up for USD/JPY as well. Only if, in the case of GBP/USD, the dollar has been weakening against the pound since the end of September, on the contrary, it has been strengthening against the yen.

The Japanese currency is a safe haven currency for investors. And its recent weakening fits logically into a stable inverse relationship between the yen rate and the growing risk appetite of the market. It should also be added that another trigger for the yen's weakening was the shift in Japan's trade balance towards imports, due to a spike in energy and metal prices. And, of course, one cannot ignore such an important factor influencing the USD/JPY quotes as the yield of US Treasury bonds. However, it is also directly related to the market's risk-aversion.

USD/JPY upgraded its four-year high on October 20 to reach 114.70 high, the very point where it was in November 2017. After that, the enthusiasm of the bulls subsided, and the pair went down, ending last week at 113.95.

At this stage, 70% of analysts expect the pair to first return to the 113.00 horizon, and then drop to the 111.00-112.00 zone by the end of November. The remaining 30% of experts adhere to the opposite point of view, expecting the next update of multi-year highs and the rise of the pair to the range 115.00-116.00.

The resistance levels are 114.35, 114.70 and 115.50, the long-term target of the bulls is the December 2016 high of 118.65. The nearest support levels are 113.85, 113.40 and 113.25, then 112.00 and 111.65.

As for the events of the coming week, the release of the report of the Bank of Japan's Monetary Policy Committee meeting on Tuesday November 02 could be noted. However, it is likely the market will react to it fairly calmly. Especially since this event will take place just one day before the US Fed meeting, which will be the focus of all investors and speculators.

CRYPTOCURRENCIES: Ethereum Renews Its High

- The historical record of $66,925 set by bitcoin on October 20 has not yet been broken. The imminent correction that followed taking that height brought forward a fierce bull and bear fight. The forces proved to be about equal. As a result, after swaying in the $57,590—63,645 range, the pair returned on Friday October 29 to roughly where it had been seven days earlier, to the $62,000 zone. The total crypto market capitalization is also unchanged at $2.6 trillion, but bitcoin's share has decreased somewhat: its dominance index has dropped from 45.94% to 44.15%. This was due to capital flows into altcoins, primarily ethereum, which rose from 18.72% to 19.61% over the week. The Crypto Fear & Greed Index is still in the Greed zone at 70 points (75 weeks ago).

Most analysts believe that the upward trend of the BTC/USD pair will continue. This is supported by statistics. Coin outflows from the exchanges have resumed, according to Glassnode. Bitcoin network hash rate has almost recovered after China's mining ban, which caused it to drop by 50%. At the same time, bitcoin supply is quite low: miners and investors are holding their reserves in the expectation of further price growth.

The macroeconomic background is also favourable. The New York Stock Exchange continues to list bitcoin-related ETFs. True, there is information that the Securities and Exchange Commission (SEC) is likely to reject Valkyrie's application to launch a leveraged ETF. Other of the 40 filings currently under consideration by the SEC, apart from applications to launch ETFs on bitcoin futures, will not receive the green light either. But those that will be approved are quite enough to ensure a solid inflow of funds into this sector from investors saving their capital from inflation.

The good news for BTC is that payments giant Mastercard will soon announce cryptocurrency support on its network. This includes bitcoin wallets, credit and debit cards, and loyalty programs where points can be converted into digital assets.

The American company Walmart Inc., which operates the world's largest wholesale and retail chain, has also turned to the main cryptocurrency and launched a pilot program to sell bitcoins in its stores.

Crypto trader and analyst known as Altcoin Sherpa is confident that bitcoin will not fall below the $54,000 zone where the strong support is located and, pushed back from it, will update its historic high in November, exceeding $80,000.

Another prominent analyst, PlanB, also expects a parabolic increase in the price of bitcoin. As a reminder, PlanB is the creator of the Stock-to-Flow (S2F) model, which predicts the price of the flagship cryptocurrency, and which allowed it to accurately predict BTC prices in August and September. And if bitcoin continues to follow this model, it will reach $98,000 in November and $135,000 in December. “So, it's going to be a really good Christmas this year,” declared PlanB. At the same time, the expert believes that the flagship cryptocurrency is unlikely to be able to avoid another major correction that historically follows each major bull cycle.

Another popular cryptanalyst and trader Lark Davis expects that “the next six months are likely to be mega-crazy for bitcoin and cryptocurrencies! Many of you will get the chance to completely change your financial destiny,” he tweeted.

Davis does not advise investors to get carried away with speculative altcoins and NFTs in the current situation, but to bet on time-tested coins. “Let the winners win, double and even triple your positions and cut the losers. Do it mercilessly, there is no point in keeping dubious assets,” writes Lark Davis.

In his view, BTC could increase investor savings by 20 times over the next 10 years, but individual altcoins could generate comparable returns much sooner. “Altcoins are for making money, BTC is for storage,” the expert explains.

The leading altcoin seemed to have heard Lark Davis's words. While bitcoin was hovering around $60,000-61,000, ethereum renewed its all-time high, peaking at $4,447 on October 29. The previous record of $4,360 was set back in May.

The ETH/USD pair is bursting up for the fifth week in a row, having added more than 65% since September 21. The reason for this growth is the coin-burning process that takes ETH tokens out of circulation. Another factor that pushed this altcoin up was the news of the successful start of the Ethereum 2.0 Altair update for the Beacon Chain, which brought the moment of the full launch of ETH 2.0 even closer.

And another piece of news that will be of interest for those who think not only about their future, but also the future of their children and loved ones. Russian insurance company Renaissance Life and InDeFi SmartBank have started jointly developing smart contracts to help inherit digital assets. With the growth of the cryptocurrency market, the problem of inheriting such property has become quite acute. Since cryptocurrencies are decentralized, in the event of the death of the owner, the heirs simply cannot dispose of the property of the deceased without access to the cryptocurrency wallet. Smart contracts under development should solve this problem by enabling the client to transfer the disposal of digital assets to their designated heir in the event of their death.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.